Consulting Case Interview Prep: Private Equity Acquisition

When you decide to pursue a career in management consulting, you accept the fact that you will need to ace a few case interview rounds before you can sign the employment contract. A business situation will be presented to you; you are expected to analyze the scenario and generate sensible recommendations within a limited period of time.

This type of interview aims to assess how you apply logic in resolving an ambiguous and stressful situation. The prospective firm wants to know if you are analytic, organized, and sharp enough to handle the responsibilities and duties of a consultant. Your communication skills will also be evaluated as this ability is crucial in conveying important messages to both client employees and top management.

Importance of Practice

The key to mastering this challenge is practice. Familiarizing yourself with various business cases and frameworks equips you with an in-depth understanding about the nature, requirements, and process of the interview. Take full advantage of the free resources on the websites of top consulting firms such as McKinsey, Bain, BCG, and other reputable firms.

As an additional preparatory material, below is a private equity acquisition case taken from Consulting Job Academy, one of the best online courses for management consulting applicants. This excellent example details the logical process of arriving at the final conclusion, thereby giving you concrete guidelines on how to manage your actual case interview.

Scenario

Greystone Partners, a North American-based private equity firm, is considering the acquisition of Deluxe Cane, the leading manufacturer of walking canes for the elderly in the US. Greystone Partners has engaged your team to help determine whether to proceed with the investment.

Here is the data we have:

Case Questions

Below are the questions you should answer to resolve the case:

- Estimate the market size for walking canes in the US. Is the market attractive?

- How is the financial performance of Deluxe Cane?

- You have just run additional competitive analysis and found that Deluxe Cane’s two largest competitors operate as part of larger organizations that sell related mobility devices. Using all the information you have collected thus far, do you believe Deluxe Cane is competitively positioned?

- What other issues would you want to analyze before making an investment decision?

- Should Greystone Partners invest in DC?

Case Solutions

Below are the detailed answers to the aforementioned questions:

Question 1

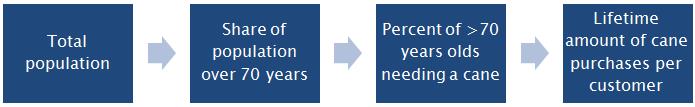

Firstly, you need to establish the structure you will use for estimating market size:

Secondly, you will make the estimations. You can either make your own assumptions or ask for inputs.

- US Population: 300 million

- Population over 70 years: 15%

- Percent of >70 population needing a cane: 40%

- Average life of cane: 5 years

Now you can do the actual calculations. The population over 70 years is 45 million and 40% of these need a cane. That is 18 million. Assuming that the average life of a cane is 5 years, one-fifth of these 18 million buys one cane every year. That is 3.6 million canes annually.

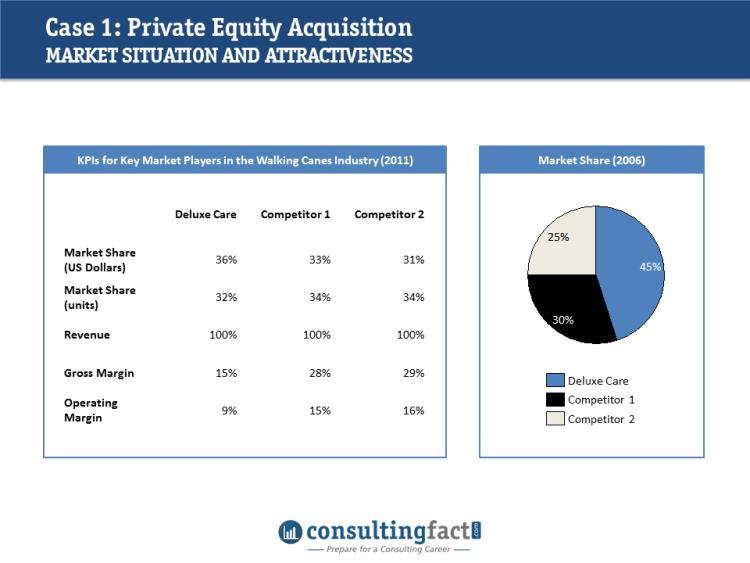

The second part of the question leads to the discussion of market attractiveness. The four factors that drive this are market performance, competition, suppliers, and customers. Because you do not have any information about suppliers and customers, you would make your analysis based on the remaining two factors.

- Market performance. You already know the size of the market, and you can see that at least Competitor 1 and Competitor 2 have solid operating margins. You should also make a comment about market growth, which is typically population-driven at about 3% per year. Aging populations will likely cause the market growth to increase.

- Competition. The competition is limited with 3 large players with about 1/3 market share for each. It would be hard for customers to find substituting products, and the fact that there are only 3 players indicates that the market is difficult to enter for new players. This is a good competition situation.

Based on this analysis, the market seems attractive. You would want to comment that an analysis of suppliers and customers is also necessary to make a sound recommendation.

Question 2

Discuss that revenues are larger than the share of volume. The prices of Deluxe Cane’s canes are higher than the prices charged by the competition. Does this matter? Yes, walking canes are largely a commodity product and the elderly, living on fixed-incomes, are price sensitive.

You should also comment that the gross margin is significantly lower for Deluxe Cane than for its competitors. This means that Deluxe Cane has much higher production costs. Don’t be tricked by the fact that they are able to charge slightly higher prices.

The financial performance is quite bad compared to the competition.

Question 3

Knowing that Deluxe Cane’s competitors are a part of larger organizations selling mobility devices should worry you. Both competitors will be able to benefit from economies of scale, and they have already priced their walking canes lower. This allows them to win market share. Deluxe Cane has lost 9 percentage points market share in the last 5 years to these competitors. As discussed earlier, Deluxe Cane’s cost structure is high relative to its peers, and Deluxe Cane has a significant material procurement disadvantage.

The conclusion is that Deluxe Cane is not competitively positioned – although it is in an attractive market.

Question 4

To answer this question, you need to analyze the target company, market performance, strategic fit and deal economics. A private equity fund does not need to have a strategic fit (as it is not a market player), but needs an exit strategy.

You have already discussed market performance and also done some analysis on Deluxe Cane. So, the two major issues left for analysis are the deal economics and exit strategy. Here are some questions that you want to analyze before making an investment decision:

- What is the likely pricing?

- Will Greystone be able to meet its return hurdles (about 20% IRR)?

- Does Greystone have related portfolio companies that might allow for procurement synergies along the lines of what the competition is able to achieve?

- Can the transaction be financed?

- What is the exit strategy?

Question 5

This should be a pretty easy conclusion to make.

No, Greystone Partners should not invest in Deluxe Cane primarily due to a difficult competitive position. Deluxe Cane is losing share to two competitors who are lower-priced and have significant built-in cost advantages.